If you enroll in the HSA Medical plan, you may be eligible to contribute to a Health Savings Account (HSA).

An HSA is a tax-advantaged savings account that lets you use pre-tax dollars to pay for eligible healthcare expenses. An HSA has several advantages:

Tax savings1: Money you contribute to your HSA goes in tax-free. It comes out tax-free too, as long as you use it to pay for eligible healthcare expenses. If you have at least $1,000 in your account, you can invest it in mutual funds, just like you do in a 401(k), and any earnings are also tax-free.

Flexibility: It’s up to you how much to contribute and when you want to use the money in your HSA. You can use it to pay for eligible healthcare expenses now or in the future — including in retirement. Money you don’t spend by year-end stays in your HSA, just like a regular savings account, and continues to build with interest. There’s no “use it or lose it” rule.

Ownership: Your HSA is yours to keep, even if you later decide to enroll in a medical plan without an HSA or if you leave Albertsons or retire. You can continue to use it to pay healthcare expenses now or in the future. You always own 100% of your HSA.

1) Contributions are exempt from federal and state income tax and Social Security tax in all states except California and New Jersey, where state income tax applies. Earnings on investments are generally tax-free. Use of HSA funds is tax-free as long you use the account for qualified healthcare expenses — see IRS Publication 969.

Tax savings1: Money you contribute to your HSA goes in tax-free. It comes out tax-free too, as long as you use it to pay for eligible healthcare expenses. If you have at least $1,000 in your account, you can invest it in mutual funds, just like you do in a 401(k), and any earnings are also tax-free.

Flexibility: It’s up to you how much to contribute and when you want to use the money in your HSA. You can use it to pay for eligible healthcare expenses now or in the future — including in retirement. Money you don’t spend by year-end stays in your HSA, just like a regular savings account, and continues to build with interest. There’s no “use it or lose it” rule.

Ownership: Your HSA is yours to keep, even if you later decide to enroll in a medical plan without an HSA or if you leave Albertsons or retire. You can continue to use it to pay healthcare expenses now or in the future. You always own 100% of your HSA.

1) Contributions are exempt from federal and state income tax and Social Security tax in all states except California and New Jersey, where state income tax applies. Earnings on investments are generally tax-free. Use of HSA funds is tax-free as long you use the account for qualified healthcare expenses — see IRS Publication 969.

HSA eligibility

To contribute to an HSA, the IRS requires you to meet certain eligibility criteria:

To contribute to an HSA, the IRS requires you to meet certain eligibility criteria:

- You must be enrolled in the HSA Medical Plan.

- You cannot be enrolled in Medicare, Tricare or in any other non-high-deductible health plan (such as your spouse or domestic partner’s health plan).

- You cannot be participating in a general purpose FSA, including one through your spouse’s employer.

- You cannot be claimed as a dependent on another person’s tax return.

HSA contributions

You can contribute up to the IRS maximum each year if you’re eligible. You contribution limit for the year can change based on your personal situation. A few factors will impact your limit, including coverage status (associate only or family), time in that status and your age.

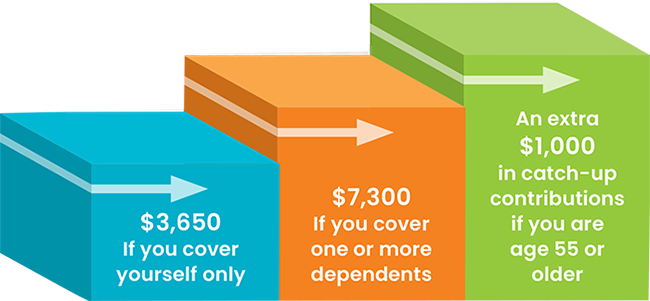

The 2022 IRS contributions limits are shown below.

You can contribute up to the IRS maximum each year if you’re eligible. You contribution limit for the year can change based on your personal situation. A few factors will impact your limit, including coverage status (associate only or family), time in that status and your age.

The 2022 IRS contributions limits are shown below.

Fidelity is the HSA administrator

If you enroll in the HSA Medical Plan and set up an HSA contribution amount at the time of enrollment, you will receive an email communication from Fidelity (or printed communication mailed to your home if no email address is on file) with instructions on how to open your HSA at Fidelity. The account must be opened before you can use it or contribute to it.

If you need assistance opening your HSA, call a Fidelity HSA service specialist at 800-544-3716.

If you enroll in the HSA Medical Plan and set up an HSA contribution amount at the time of enrollment, you will receive an email communication from Fidelity (or printed communication mailed to your home if no email address is on file) with instructions on how to open your HSA at Fidelity. The account must be opened before you can use it or contribute to it.

If you need assistance opening your HSA, call a Fidelity HSA service specialist at 800-544-3716.

Use your HSA for the everyday

You can use your HSA for your own healthcare expenses and those of your qualified tax dependents (such as your spouse and your eligible children up to age 19, or age 24 if a full-time student), even if they’re not enrolled in an Albertsons medical plan.

You can use your HSA for your own healthcare expenses and those of your qualified tax dependents (such as your spouse and your eligible children up to age 19, or age 24 if a full-time student), even if they’re not enrolled in an Albertsons medical plan.